(While the following narrative reflects actual facts and events, the client’s names are withheld to protect their privacy.)

This client was an Army Officer who left the service after a distinguished career. His military experience and educational background made him a good fit for one of the top National consulting firms. He spent the next decade helping many Fortune 500 companies reorganize to streamline their operations and bring efficiencies to their marketing programs. With consolidation in the consulting industry accelerating during the throes of the Great Recession and having grown tired of the bureaucracy of big organizations, he was ready and anxious to accept a “package” from his firm to end his employment in 2010.

He and his spouse were confident that his military discipline and management background was business skills that could transfer to the small business world. As the owners of a small business, they thought that they could finally have control over decisions that affected their lives. With the military pension helping to pay the household bills they embarked on their search for the right business.

While they were sure that they wanted to open a business, they weren’t sure which kind might be best for them or how to go about finding it. Fortunately, the FranNet Entrepreneur Profile process identifies the client’s transferable business skills and allows FranNet consultants to match clients to appropriate opportunities from a pre-vetted portfolio where the client’s profile matches the profiles of top performers.

The Army Officer Veteran’s profile indicated suitability for a business-to-business service business with light manufacturing operations. This was a strong match for the commercial graphics and signage industry. According to industry reports*, the US graphics and signage industry totals over $__.0 Billion in sales annually. As one industry insider says, “Every business location needs a ‘Now Open’ sign for its Grand Opening, advertising signage while it’s operating and a ‘Going Out of Business’ sign when it closes”. While the industry is enormous there is no dominant market share leader. It is an industry where efficient marketing programs and streamlined operations will produce a superior customer experience that should lead to success.

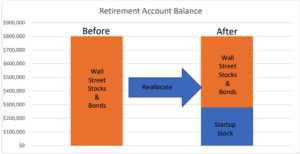

Now, how to fund the $280,000 startup budget? Military pension and savings were needed to pay current household bills. Most of the “package” payment was in additional retirement benefits so as to avoid current year tax consequences. Therefore, they were cash lean while showing over $800,000 in retirement accounts. Their FranNet consultant introduced them to the ROBS program concept to fund their franchise. ROBS is an acronym for Roll Over for Business Startup. This is a 40-year-old funding strategy known to experts whereby a business can be funded with retirement account assets without causing early withdrawal penalties or current year tax consequences.

- The process starts with the formation of a regular C corporation under the IRS guidelines.

- The new C corporation hires a firm that is an expert in ERISA laws to create a retirement plan for the new C corporation’s employees.

- The new C corporation hires the client and/or their spouse and/or children.

- The client and/or their spouse and/or children make(s) a Direct Transfer of funds in any qualified retirement account to the new C corporation’s newly sponsored retirement plan.

- A portion of the Wall Street stocks and bonds in the client’s account in the newly sponsored retirement plan is liquidated to cash.

- The cash is used to acquire stock in the new C corporation.

- The retirement account holds stock while the C corporation gets to cash in its checking account.

- The cash in the new C corporation’s checking account can now be used for any legitimate business purpose that can include payment of wages to its employees, franchise fees, startup expenses, and working capital.

The return on the investment in the startup stock, like stock in any Wall Street offering, will depend on the success or failure of the business. The difference between Wall Street stocks and the startup stock is the level of control exerted by the client. The client has no influence over the performance of Wall Street stock values but exerts overwhelming control over the performance of his own franchise business.

After a few predictable years of lower but growing income, the client became one of the top ten performing owners in their franchise system. Their performance proved out the premise of the FranNet Entrepreneur Profile process. During the four calendar years ending with 2019, the client’s ODP (Owner Discretionary Profit) averaged just shy of $250,000.00 per year.

As part of their (early) retirement plan, the client and spouse decided to sell their franchise business. During 2019 they accepted an offer of $842,00.00 for the sale of their business. The value of their $280,000 investment in startup stock at the end of 2010 grew in value to $842,000.00 before the end of 2019. Over those nine (9) years the business provided them the control over their lifestyle and income that they desired when they first made their decision. The return on investment was sufficient to fully fund their (early) retirement.