(While the following narrative reflects actual facts and events, the client’s names are withheld to protect their privacy.)

This client worked as an engineer in the aerospace and defense industry. His expertise was in the electronics of guidance systems. His work helped missiles to fly more accurately. Hence, he was, literally, a “Rocket Scientist”.

While he had only worked for one Fortune 500 company in this industry the nature of the employment was not ideal. The company’s revenue was driven by contracts that funded different projects. A single project may last for several years and require hundreds of employees but when a project reached its conclusion or when funding for a project ran out or was canceled then the project would stop. When a project stopped, all employees working on the project whose wages and benefits were funded by the project’s revenue were usually terminated by the company. The company didn’t always have a new project waiting ‘in-the-wings’ to which it could transfer all the newly inactive employees.

These employees with highly technical and specialized skills were well paid while working on a project. When termination came the company always provided some separation benefits including severance pay, outplacement services, and a period of continuing healthcare benefits. When younger, some employees would enjoy the respite between projects even though they were unemployed. After all, new projects in their industry always seemed to come along and the company had a practice of hiring back its previous employees for the next project.

However, after a few decades of this roller-coaster type of employment, the client found that the duration of the projects seemed to be getting shorter and the duration between projects seemed to be getting longer. The separation benefits were definitely not keeping pace with inflation or the lengthening of the separation duration. Just the opposite was happening. Sometimes the client would need to dip into their savings between projects to pay household bills or healthcare expenses. Certainly, the 401K account wasn’t getting any contributions in between projects.

This roller coaster employment ride became very scary, and not in a good way when during his last separation he realized that employees with now grey hair like his were the very last people hired back to the new projects. This is when the client decided that he wanted off the roller coaster. In 2012 he decided that he would find a business of his own that he could start and grow even while continuing with his corporate employment. While utilizing the outplacement services provided by his company for his last separation, he attended a presentation regarding starting franchise businesses given by a local franchise expert from FranNet. He learned there that some franchise systems had business models specifically designed to be managed by the owner in limited hours. The business model included a business manager responsible for running the day-to-day operation of the franchise business while reporting to the owner.

The client signed on to open two locations of a very highly rated franchise system that he was referred to by his FranNet consultant. His first location opened in 2013 while he was working on one of his employer’s latest projects. His corporate wages were important during this period to pay their household bills so that all cash flow from the first franchise location could be re-invested back into the opening of his second location. The second location opened just before the end of 2014.

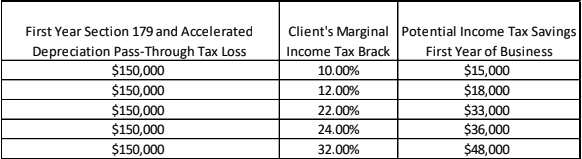

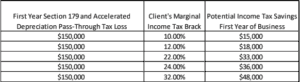

Opening the second location before the end of the tax year was very important as the tax code permits the business to expense (or write-off) most of the cost of the physical, tangible assets of the new location in the year in which the business opens. This tax write-off can ‘pass through’ to the owner’s personal tax return thereby significantly reducing taxable income and therefore income taxes due in that year*.

The client’s first two locations flourished. After a period of time during which new locations are expected to operate at a loss, the regular customer base grew to a point where each of the two locations was generating significant income. The results of their first two locations were so outstanding that the client was named 2015 Franchisee of the Year for his entire franchise system that included hundreds of locations.

It was after 2015 that the client realized that after three years in the business he was earning twice as much income from his first two franchise locations as he was from his corporate employment … so he quit. He got off the roller coaster, but he was getting on a different kind of ride. Being a business owner is not just a career choice, it is an entirely different lifestyle.

In 2016 the client signed on to open his third franchise location of the same franchise system. Given he already had the experience of opening two locations, the third held little surprise for him. Given that he was already an outstanding owner it was no surprise that the third location also had outstanding results.

Now with retirement age clearly on the horizon, the client was sure that he had overcome a sputtering 401K account. He had grown a retirement plan that included an asset paying annual dividends more than twice his previous corporate income but requiring less than one-half of the time previously devoted to working. This asset could even be managed remotely while they traveled as there are telephone and internet services available around the world. It didn’t take a “Rocket Scientist” to know that he had made a great career decision when he chose to attend the workshop given by his local franchise expert from FranNet.

* FranNet consultants do not provide tax or legal advice. Please consult your own professional advisors for tax and legal advice.