With summer on the horizon, you might already be hearing complaints of boredom from your child or endless requests for money so they can go to the movies or mall with their friends. If your kid is desperate for something to do this summer—or if you’re desperate for a little extra help around the office or store—putting your child to work is the perfect solution for everyone!

Here are four reasons why you should hire your child to work for your franchise.

1) You’ll get to spend more time together

By hiring your teen to help out with basic tasks like cleaning, filing, database work, or warehousing, you’ll have the chance to spend more time with them. You’ll not only develop a shared experience to bond over but also have a great chance to share your wisdom and work ethics with your kid. While you work together, you can also teach them the skills, attitude, and professionalism they’ll need to succeed in future jobs.

2) It’s a chance to save for college

Since you’re the boss and the parent, you’ll have more control over where your child’s paycheck goes. Consider putting that hard-earned money right into a savings account for college, and use it as an opportunity to teach your teen about the importance of saving money. Plus, they’ll thank you later when they’re able to afford their dream school.

3) You might not have to pay taxes

If your child is under 16 and you’re the sole proprietor or LLC of your business, you won’t have to pay any Social Security of Medicare taxes. If you’re an S-Corp or C-Corporation, you will have to withhold taxes, but your teen will likely receive them back as a refund after tax season. Since the rules can vary by state, talk to your accountant if you have any questions or concerns, and be sure to keep good documentation of your child’s work.

4) You can take a deduction

If your child is performing reasonable work for your business—business that you would pay someone else to do—then you can take a deduction on your taxes. Plus, you can still claim your child as a dependent or receive their tax credit.

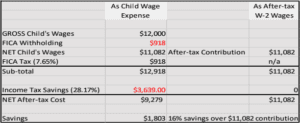

Save 16% on 529 College Savings Plan Contribution

Taxes are complicated and you should consult with your own professional tax and financial advisors regarding your family’s particular situation. The below example assumes a small business organized as a limited liability company but taxed as an S-corporation. The parents desire to contribute $11,082 to their child’s 529 College Savings Plan. They can do that with their own after-tax W-2 wages and business profits of $11,082.

Or, they can hire their child under the age of 19-years-old and pay them gross annual wages of $12,000. This is the maximum amount of wages that will incur no income tax liability for the child. FICA employment taxes must still be withheld for social security and medicare contributions so net wages is only $11,082. The business must also contribute FICA taxes of the same amount so the total expenses to the business amount to $12,918. These completely justified expenses to the business reduce its profit that passes through to the business owners (parents) personal income taxes. Taxable income is, therefore, reduced by $12,918. Assuming a 24% Federal Income Tax bracket (for single filers with income between $84,201 and $160,725) and a 4.17% State Income Tax bracket (a ‘low’ tax Western state), then income taxes will be reduced by a combined amount of $3,639 (28.17% of $12,918). After the tax savings the NET cost of the $11,082 529 College Savings Plan contribution is only $9,279 ($12,918 – $3,639). This amount is 16% lower than the direct after-tax contribution of $11,082. The parents must ensure that all of the child’s net wages go into the 529 Plan to get the full benefit.

Hiring your child to work for you is a great opportunity to teach them the professional and money-saving skills they’ll need to succeed in life and can also be a great business decision for you and your franchise. With financial and family-friendly benefits like these, hiring your child is a decision that’s sure to make everyone happy.